dc income tax withholding calculator

New job or other paid work. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages.

What Is The Bonus Tax Rate For 2022 Hourly Inc

The amount of income you earn.

. Has relatively high income tax rates on a nationwide scale. Not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me. In the past auditors manually.

When you have a major life change. Medicare Tax is 145 of each employees taxable wages until they reach 200000. Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount computed in.

FICA taxes are made up of two components Social Security Tax and Medicare Tax. D-4 and file it with his her employer. Enter annual income from 2nd highest paying job.

Your average tax rate is. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay. 2014 Income Tax Withholding Instructions and Tables.

The information you give your employer on Form W4. 2012 Income Tax Withholding Instructions and Tables. Withholding Formula District of Columbia Effective 2021.

The tax rates for tax years beginning after 12312015 are. Total expected income this year. Withholding Formula District of Columbia Effective 2022.

D-4 Fill-in Employee Withholding Allowance Certificate. Check your tax withholding every year especially. When to Check Your Withholding.

For employees withholding is the amount of federal income tax withheld from your paycheck. Federal and DC Paycheck Withholding Calculator. Individual and Fiduciary Income Taxes The taxable income of an individual who is domiciled in the District at any time during the tax year or who maintains an abode in the District for 183 or more days during the year or of a DC estate or trust is subject to tax at the following rates.

The tax rates for tax years beginning after 12312021 are. 2013 Income Tax Withholding Instructions and Tables. Each allowance you claim reduces the amount withheld.

Social Security Tax is equal to 62 of your employees taxable wages up to an annual total of 147000. After a few seconds you will be provided with a full breakdown of the tax you are paying. Income tax brackets are the same regardless of filing status.

Withholding Tax Forms for 2017 Filing Season Tax Year 2016 Please note the Office of Tax and Revenue is no longer producing and mailing booklets. The amount of income tax your employer withholds from your regular pay depends on two things. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Dependent Allowance 1775 x Number of Dependents. OTR will charge 10 percent interest compounded daily on any underpayment of estimated taxes. 2015 Income Tax Withholding Instructions and Tables.

Enter annual income from highest paying job. If you make 70000 a year living in the region of Washington DC USA you will be taxed 13271. How many withholding allowances you claim.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Rates for Tax Year 2022 Tax Rates. Find your pretax deductions including 401K flexible account contributions.

In 2005 the Office of Tax and Revenue OTR began to automatically charge a penalty for underpayment of estimated tax by any person financial institution or business. The amount you earn. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages.

D-4A Fill-in Certificate of Non-residence in DC. If you withhold at the single rate or at the lower married rate. As an employer you are responsible for matching the same amount each.

Income Tax Calculator 2021. File with employer when starting new employment or when claimed allowances change. File with employer when requested.

If you changed your tax withholding mid-year. For help with your withholding you may use the Tax. Apply the taxable income computed in step 5 to the following tables.

Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount computed in. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. Capital has a progressive income tax rate with six tax brackets ranging from 400 to 1075.

This change took effect January 1 2005 for tax year 2004 returns. See withholding on residents nonresidents and expatriates. Check your tax withholding at year-end and adjust as needed with a new W-4.

Enter pay periods per year of your highest paying job. Not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me. Determine the dependent allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income.

Multiply the adjusted gross biweekly wages by 26 to obtain the annual wages. Overview of District of Columbia Taxes. 2011 Income Tax Withholding Instructions and Tables.

Child birth or adoption. It depends on. If you have a third job enter its annual income.

1101 4th Street SW Suite 270 West Washington DC 20024. The District of Columbia income tax has six tax brackets with a maximum marginal income tax of 895 as of 2022. Number of Dependents Under Age 17.

2014 Income Tax Withholding Instructions and Tables.

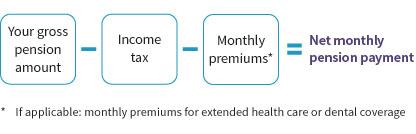

Tax Information For Retired Members Teachers Teachers

Opt Student Taxes Explained Filing Taxes On Opt 2022

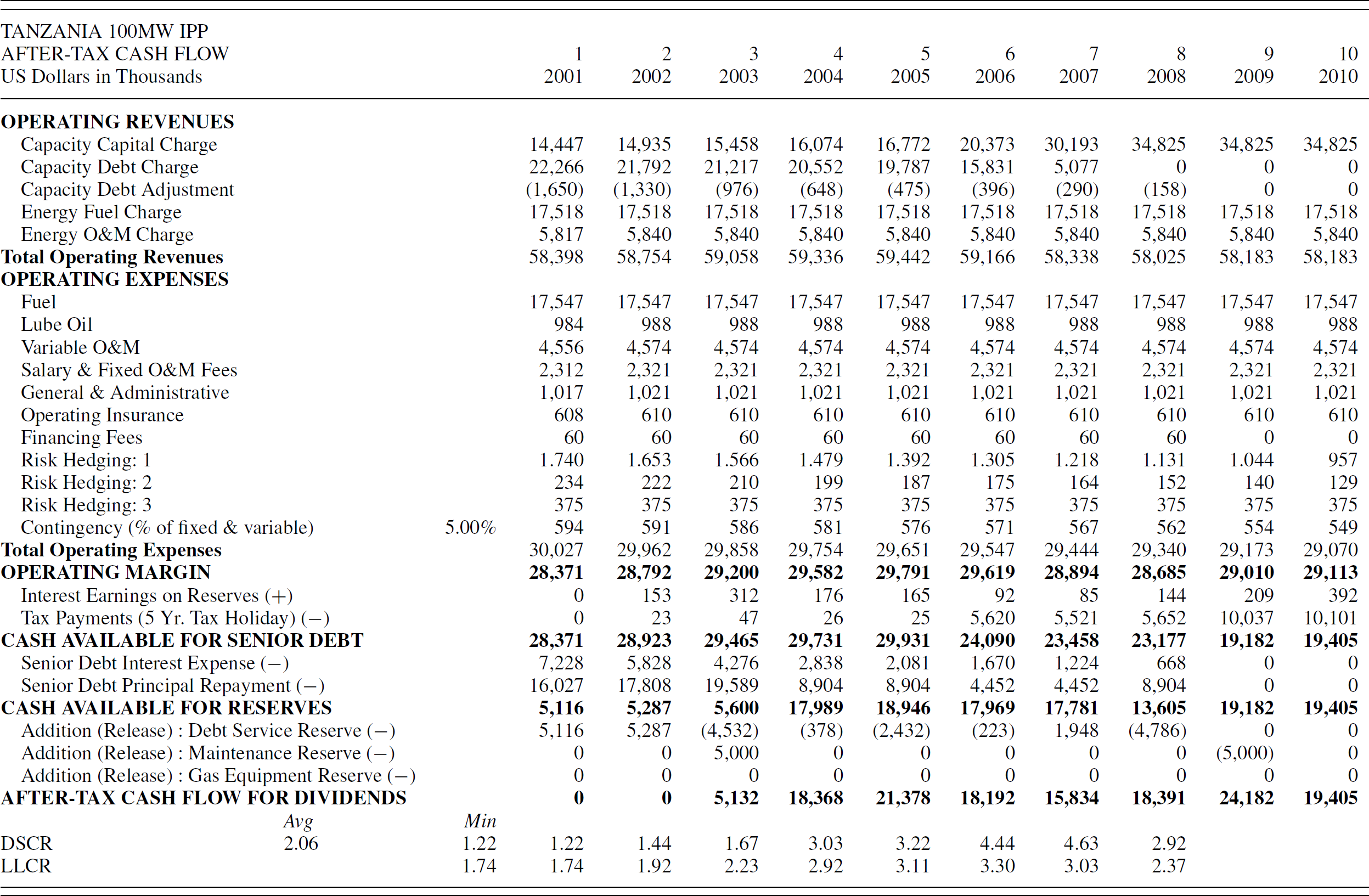

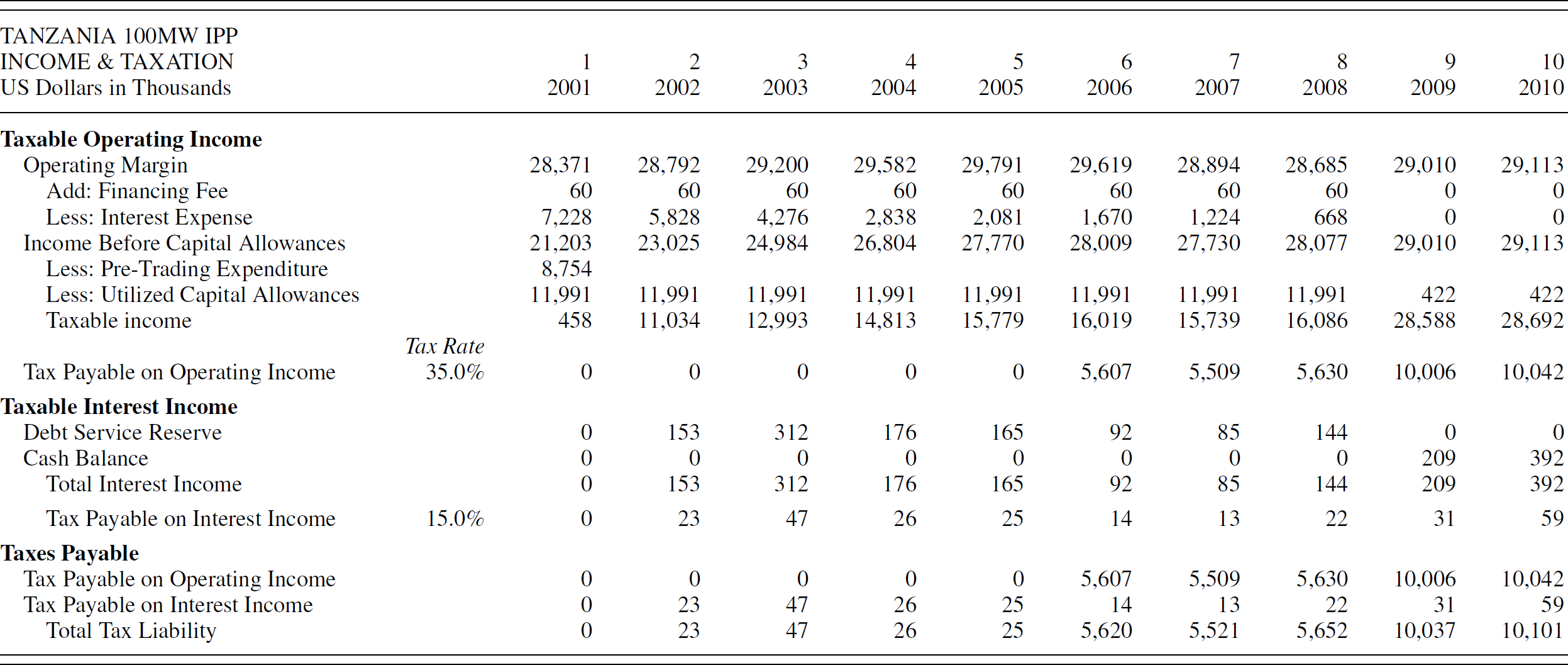

Tanzania Electric Supply Company Limited V Independent Power Tanzania Limited Icsid Reports Cambridge Core

Saas Sales Tax For The Us A Complete Breakdown

Behavioral Effects Of Tax Withholding On Tax Compliance Implications For Information Initiatives Sciencedirect

Corporate Income Tax Definition Taxedu Tax Foundation

Corporate Income Tax Definition Taxedu Tax Foundation

Annuity Taxation How Various Annuities Are Taxed

Why Work From Home May Bring Major Business Tax Implications Netsuite

New Zealand Tax Income Taxes In New Zealand Tax Foundation

New Zealand Tax Income Taxes In New Zealand Tax Foundation

Tanzania Electric Supply Company Limited V Independent Power Tanzania Limited Icsid Reports Cambridge Core

Tanzania Electric Supply Company Limited V Independent Power Tanzania Limited Icsid Reports Cambridge Core

Do You Need To File A Tax Return In 2022 Forbes Advisor

Corporate Income Tax Definition Taxedu Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Each Year The Internal Revenue Service Announces New Annual Inflation Adjustments For The Next Tax Year Here Irs Taxes Tax Brackets Internal Revenue Service

:max_bytes(150000):strip_icc()/Tax_Advantages_Buying_Home_Sketch-ffc74833ef7744f2ba7377009ff52274.png)